|

|

|

|

|

|

|

||||

|

|

||||

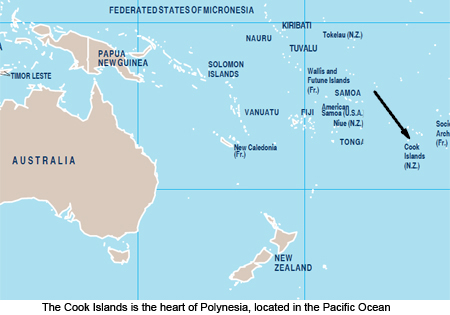

Rarotonga (Cook Islands), 25 August 2011 - Life just got harder for money launderers and organized criminal gangs throughout the Pacific. The newly reestablished Cook Islands Computer-Based Training (CBT) Centre joins an expanding Pacific Region anti-money laundering training network for law enforcement and financial officers.

"Money laundering is one of most lucrative and largest activities used by transnational organized crime gangs as they move into the Pacific," said Mr. Gary Lewis, Regional Representative of the UNODC Regional Centre for East Asia and the Pacific. "The Computer-Based Training Centres will give Pacific law enforcement and bank officials the latest anti-money laundering tools, techniques and risk management and profiling strategies."

To date, under the Global Programme against Money Laundering, Proceeds of Crime and the Financing of Terrorism (GPML) initiative, two Computer-Based Training Centres have been established in the Pacific - in Fiji and the Cook Islands. This highlights a strong UNODC commitment in fighting anti-money laundering in the Pacific.

The Centres are located in the Cook Islands Financial Intelligence Unit (CIFIU) and the

Fiji Financial Intelligence Unit (FFIU). They are part of a Pacific Region anti-money laundering network supported by UNODC as part of its Global Programme against Money Laundering, which has a component called the Pacific Anti-Money Laundering Programme.

The Cook Islands Centre will train police, customs, bank and offshore fund financial officers using more than a dozen modules under the Computer-Based Training Anti-Money Laundering Course. Examples of the training modules include: "an introduction to money laundering"; "why criminals need to launder money"; "money laundering methods"; "financial havens"; "the roles and responsibility of the Financial Intelligence Unit"; "how financial investigations are conducted"; "undercover operations"; "net worth analysis"; "search operations"; "interview and interrogation of suspected persons"; "interdiction techniques for airports and seaports", "net worth analysis and risk management".

Mr. Walter Henry, Senior Intelligence Officer at CIFIU explains that "…having experienced great benefits from this training, we see this programme being utilized in the future to support all our stakeholders to tackle transnational financial crimes."

BACKGROUND

The UNODC Global Programme against Money Laundering, Proceeds of Crime and the Financing of Terrorism under the Pacific Anti-Money Laundering Programme assists participating financial institutions to increase their financial capabilities to fight organized transnational crime in areas of anti-money laundering and counter-terrorist financing.

Since 1999, the UNODC Computer-Based Training Programme has been providing Member States with technical assistance to address a range of issues related to transnational organized crime. The existing UNODC curriculum contains 90 modules and is available in 18 languages. New modules under development include training on smuggling of migrants and wildlife trafficking. It is delivered via 300 established centres in 52 countries. More than 100 of these centres are in East Asia and the Pacific. The CBT Unit coordinates and implements operations from the Regional Centre in Bangkok.